Effective Risk Management Techniques for Crypto Traders

The World of Cryptocurrency Trading is Known for its High Volatility and Unpredictability. The Rapid Price Fluctuations, Market Downturns, and Regulatory Changes Can Make It Challenge to Navigate the Markets. In this article, we will discuss effective risk management techniques for crypto traders to help them protect their capital and achieve their financial goals.

Why Risk Management is crucial in Crypto Trading

Cryptocurrency Trading Involves Taking Risks That Are Not Replicable in Traditional Investments. The high volatility of cryptocurrencies can lead to significant losses if not managed properly. Without Proper Risk Management, Even the Best Traders Can Suffer Substantial Loss Due to Market Fluctuations, Regulatory Changes, Or Unexpected Events.

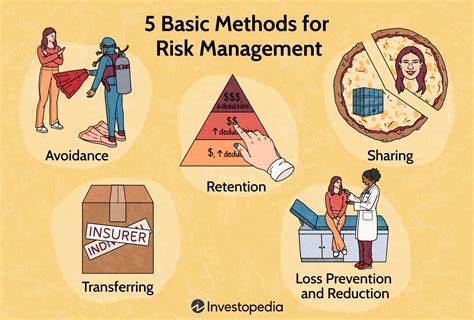

Common Risk Management Techniques for Crypto Traders

- Position Sizing : This Involves Determining How much capital to allocate to Each Trade. It’s Essential to set realistic limits and avoid over-supplies your position.

- Stop-Loss Orders : These orders automatically Sell an Investment IF it falls below a Certain price, Limiting Potential Losses.

- Take-profit Orders : Set Stop-Loss Orders for Each Profit Goal, Allowing you to Lock in Gains While Minimizing the Impact of Market Downturns.

- Hedging strategies : This Involves Using Derivatives or Other Instruments to Reduce Risk by Offsetting Losses with Gains From Another Trade.

- DIVERSification : Spread Your Investments Across Different Assets and Markets to Minimize Exposure to Any One Partular Market or Sector.

Technical Analysis (TA) Techniques

- chart patterns : Identify Potential Buy/Sell Signals on Charts, Using Indicators Like Moving Averages, Relative Strength Index (RSI), and Bollinger bands.

- Trend Following : Set your trading strategy based on the direction of price Movements and Adjust Accordingly.

- Mean Reversion : Identify Overbought or Oversold Conditions and the Against Them.

Fundamental analysis (FA) Techniques

- Economic Indicators : Monitor Key Economic Indicators Like GDP, Inflation, and Interest Rates to Anticipate Market Trends.

- Company Performance

: Analyze A Company’s Financials, Management Team, and Product Offerings to Determine its Potential for Growth.

Risk Management Tools

- Technical Analysis Software : Utilize Specialized Software Like TradingView or Metatrader to Analyze Charts and Identify Trading Opportunities.

- Risk Management Platforms : Implement Risk Management Tools Like Liquuidity Pool (LiquiPool) OR BitMex’s Risk Management System to Manage Positions and Limits.

- Cryptocurrency Exchange : Use an Exchange Like Binance or Coinbase, which sacrifice build-in-risk management features.

Best Practices for Effective Crypto Risk Management

- Educate yourself : Continuously Learn about the Markets, cryptocurrencies, and trading strategies.

- Stay disciplined : Stick to your strategy and avoid impulsive decisions based on emotions or short-term market fluctuation.

- Use Diversification Techniques : Spread Investments Across Different Asset Classes, Markets, And Sectors to Minimize Risk.

- Monitor Markets Closely : Keep an Eye on Global Events, Regulatory Changes, and Economic Indicators That May Impact the Market.

- Regularly review and update Your Strategy : Continuously Assess Your Trading Strategy’s Effectiveness and Adjust it as Needed.

Conclusion

Effective Risk Management is Crucial for Crypto Traders to Protect Their Capital and Achieve Their Financial Goals. By Implementing these Techniques, Using Technical Analysis Tools, And Adopting Best Practices, You Can Reduce The Risks Associated With Cryptocurrency Trading and Increase Your Chances of Success In This Rapidly Evolving Markets.